How does CRS affect financial services companies in Hong Kong?

CRS is an acronym for the OECD’s Common Reporting Standard. The CRS framework was setup to combat tax evasion and protect the integrity of tax systems, but what exactly is it? Which countries are participating and what are the implications for financial services companies in Hong Kong? This article will help you understand CRS and how it may affect you under the incoming CRS requirements.

What is CRS?

For the CRS framework, companies in Hong Kong are required to identify and annually report to the Inland Revenue Department (IRD) the financial accounts of tax residents of foreign reportable jurisdictions. The information can include; bank deposits, securities accounts, assets, insurance products etc. The reporting standard helps to standardise the submission of information, to make it easier for information to be shared and analysed between the participating countries.

Which countries are participating?

A detailed list of the reportable jurisdictions can be found here. Currently, approximately 75 jurisdictions are participating, including all EU member states, Australia, Canada, China (including Hong Kong), India, Korea, Malaysia, Russia and Switzerland.

Consequently, If any of your clients are from one of these countries and have accounts in Hong Kong, you’ll need to start preparation to create the reports to submit to the IRD.

What should you do?

At the minimum, you need to start by making sure you have up to date and relevant information on your clients. It is important that this data is accurate. You should begin communication with your clients to establish whether you’ll need to report on them. We would recommend sooner rather than later. You will also need to be mindful of this when you onboard new clients.

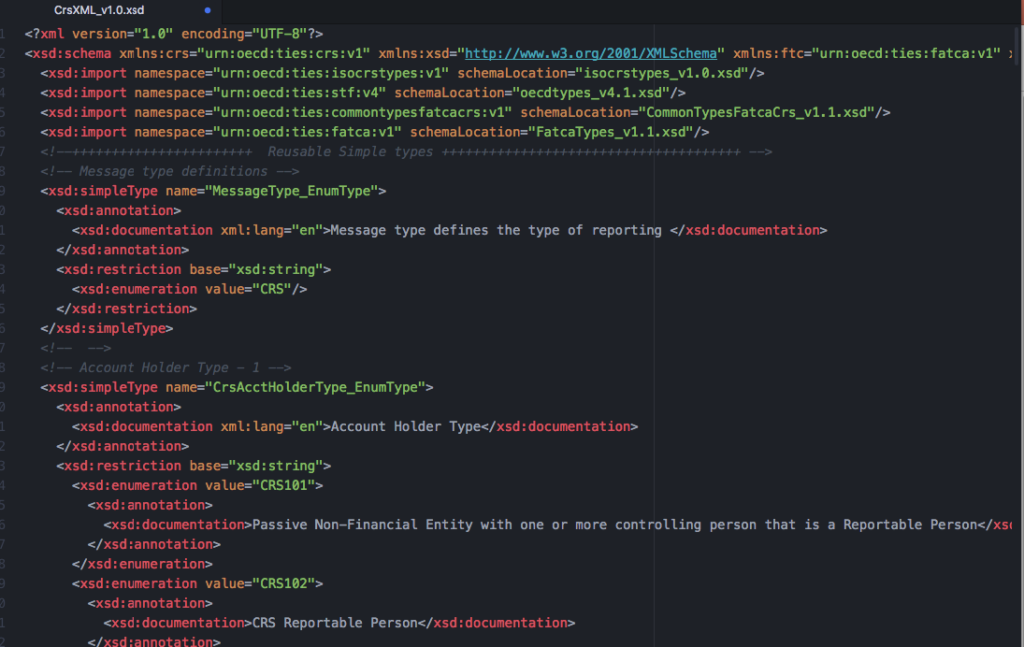

If the required client data is not on a database or online system (such as our Link|FS platform) then we recommend you begin to digitise your data to remove reporting headaches that will appear later. This is what the data looks like for reporting. It’s in XML format:

What’s next?

From September 2017, the IRD Portal comes online for registration and in January 2018, the IRD started to issue information requests. The reporting and sharing of information between countries began at the end of 2018. You can automate your reporting by adding onto existing internal processes you may have (provided you have some digital records) and you can connect to the IRD portal for automatic uploads, making the process much smoother and reducing the room for error. More information here.

Note. Some of the dates mentioned above have changed in the past so it’s important to keep up with any changes that may affect you. We’ll post about them on our updates page.