In a world where everything has gone digital, and according to a statement made by the highly successful entrepreneur and investor, Marc Andreessen –

Software is eating the world

Why do people want to fill out a form with a pen?

Over the past 6-12 months I have onboarded/opened accounts with the following products/services:

- Credit Card

- Personal Bank Account

- Business Bank Account

- 2 Insurance Products

- Securities Brokerage Account

Most of them with large companies (I won’t name names here) with almost infinite resources to spend on a good client onboarding experience. Keeping in mind, this was their first interaction with a (potentially) new client! Out of the 5, only 1 was simple, smooth and almost friction free.

So what was good about it?

- No requirement for me to figure out which form I need and download a PDF – Check ☑️

- It worked on mobile and laptop – Check ☑️

- I could save an application during the process, come back later and complete – Check ☑️

- It was easy to get support in real time if any questions required – Check ☑️

- There were relevant status updates during the process – Check ☑️

- Provision of a handy welcome pack to get me started – Check ☑️

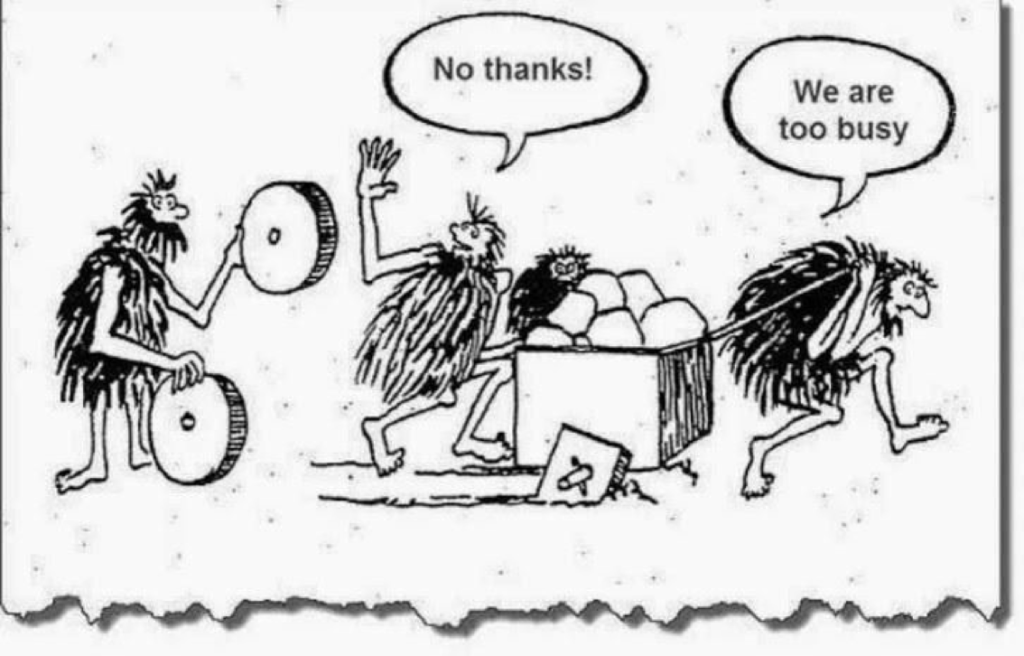

The key thing here is, if you start with a PDF or paper form, the rest doesn’t really matter because it probably won’t happen. If you lock data into a paper form, it either won’t get actioned or won’t get transitioned properly to a database. And if it does, it will be too late to make a difference. So why do so many companies still want to do things this way and are we as consumers still “ok” with it? And what is it?

More secure? More authentic? Or even nostalgic???

Or is it just easier to unload a lot of information via a pen rather than a keyboard? The end users completing these forms can be across different generations so it’s hard to nail down a good stat on whether someone prefers digital to analogue. Trust me, I’ve searched.

From the people we have spoken with during meetings and product demos, we always asked the direct question:

Would you prefer to complete this form with a pen or a keyboard?

The answer we get most often is “it depends”. However, if you ask the companies who are currently using some form of digital client onboarding to collect customer information, their overwhelming preference is digital. Why?

Single source of truth

Reduce risk (KYC/AML)

Streamlining and automation

Simplified reporting and compliance

Data accuracy (and associated analytics benefits)

With these proven benefits in mind, what has stopped the majority of companies going digital before now? We see 4 major hurdles to switching to digital client onboarding vs pen and PDF:

- Cost

This was always going to be a factor. Digital transformation is not always easy. Maybe they have tried to build something in the past and ended up with something that was costly and might not have done the job?

Maybe they bought some whiz-bang solution but the implementation was poor and they struggled to see the value. Or, maybe they have a system that ‘works’ now, so why spend money?

A lot of companies now understand they must move with the times and go digital. However, when they explore the options in the market they’ll often reach these conclusions:

- There are high upfront license implementation costs

- High annual maintenance/ongoing costs

- Expensive change requests for customisation

- Training programs and specialist requirements

- Time to Value

From the time it takes to get buy-in from executives/senior management to actually seeing results, one might think it’s never going to happen and those costs mentioned above can stack up. Long integration times with vendors, internal IT push back, aligning the business with the technology, internal procurement processes etc. These factors can all slow things down.

Some vendors are trying to reduce this time and the concerns around it by offering more of a ‘turn-key’ solution. But can one size fit all? In terms of KYC/AML, the same regulations apply to everyone within a particular region. For example, if you’re onboarding clients in Hong Kong (regulated by the SFC or HKMA) you will need to abide by the same regulations as your competitors. The process can vary from company to company but the variations should not be so large as to require an entire bespoke solution for every company. Cross jurisdictional onboarding is another matter, but often each country has it’s own team to handle local matters, or can advise on cross jurisdictional issues to tie it all together.

- Integration

Most companies have already invested in technology in various areas of their business. Most of the core systems that keep their businesses alive are digital. But how do we integrate and take advantage of data we already have?

Thanks to advances in modern software and the proliferation of API’s (Application Programming Interfaces) that let applications talk to each other securely, the integration times have dropped significantly. What can happen though, is the integration times can get slowed down (affecting Time to Value) because various business units want to control the applications and data they use every day. The hand off between middle office and back office functions is not always clear cut and they may be at different stages in application deployment lifecycles. “Let’s wait until we upgrade before we integrate”. There goes another 3 months.

- Digital signatures/Biometrics

This technology has been around for a long time and is proven. But for most of the regulators, they’re not there yet. If regulators accepted digital signatures or biometric identity verification, client onboarding would be half the pain point that is it.

For a lot of the financial services products, if you want to onboard completely remotely you need to jump through many hoops and often need a lawyer, bank manager or a JP to verify a copy of your identity documents. Otherwise you need to find the time to physically meet with the company to complete the process, depending on which regulator the company you deal with falls under. For some products face-to-face is very worthwhile (building relationships and trust) for others, you just want to buy the service and move on.

We’ve heard the argument “If we can only do 90% digitally, then need to print and sign a document anyway, doesn’t it defeat the point of the digital process?”. .. well kind of….. If you can digitise and automate 90% of a current slow, clunky process, then you’re 90% of the way there for when the regulators catch up to the technology. There’s a good chance your competitors are thinking this too.

Add humans, not software

As financial services companies grow and the regulatory pressure stacks up, compliance/operations teams have grown. The knee-jerk reaction to alleviate pressure on business units being swamped by increasing workloads is to add staff, not technology. This does not scale. It all amounts to a larger set of moving parts that become harder to manage. You’re kind of reverse streamlining and scattering things around.

At least 40% of all businesses will die in the next 10 years… if they don’t figure out how to change their entire company to accommodate new technologies. — John Chambers, Cisco

Every boardroom across the world has discussed ‘going digital’ at some point and some have charged ahead, some have dabbled/dipped into technology and others just keep talking about it. The ones that charge ahead and get it right, win. The others, may be in a position of watching them win. Goldman Sachs recognised some time ago that they are a tech company and this thinking has seen them become even more successful, and they now compete with Google and Facebook for tech talent.

In this article, I’m only talking about a small part of your business going digital, but it could be the most important part, as it’s where the customer first touches your company. With the proven benefits of going digital and the reasons for NOT going digital clearly reducing, the shift has begun and ultimately, we will all reap the benefits. Both as consumers and as companies.

We don’t fully address it in this article, but one of the biggest benefits of going digital is the data. Once you have enough clean, quality data, you can extract value from it through analytics. It’s difficult to get clean, quality data from paper and PDFs. Analytics is absolutely within reach of even SME businesses today with advances in technology and a highly competitive marketplace.